FINANCE

Predicting

Financial Markets

Quaternion Technology provides state-of-the-art Artificial Intelligence models for finance.

Our scientific team learns from data by mixing computer science and human expertise to elaborate a customized solution that will help our clients increase their revenues.

We use cutting edge scientific theories, state-of-the-art technologies, information, human skills, and intuition to confront the world’s most complex problems and find solutions that were once thought to be unaccessible.

The ultimate goal is to create models from different branches of Artificial Intelligence, Physics and Mathematics in order to describe and predict financial time series.

Soft

Computing

Soft Computing is a method that, opposed to traditional computational tasks, has the objective to shape complex systems in the real world managing the inaccuracy, uncertainty and the incompleteness of the information. The main goal is to achieve computational handling and feasible solutions combinating 3 fundamental components: Complex Fuzzy Logic, Neural Networks and Genetic Algorithms. Soft computing techniques make it possible to build systems that are highly adaptive to constantly changing conditions in the external environment.

Quantum

Decision Theory

Quantum Decision Theory provides an intrinsic probability framework, which describes decision making and non commutativity of decision, modeling and predicting human purposes. This is a good theory that enables modeling of the irrational and subjective aspects of the decision making, being inspired by Quantum Mechanics, fundamental theory in physics that provides a description of the physical properties of nature at the scale of atoms.

Train

Algorithms

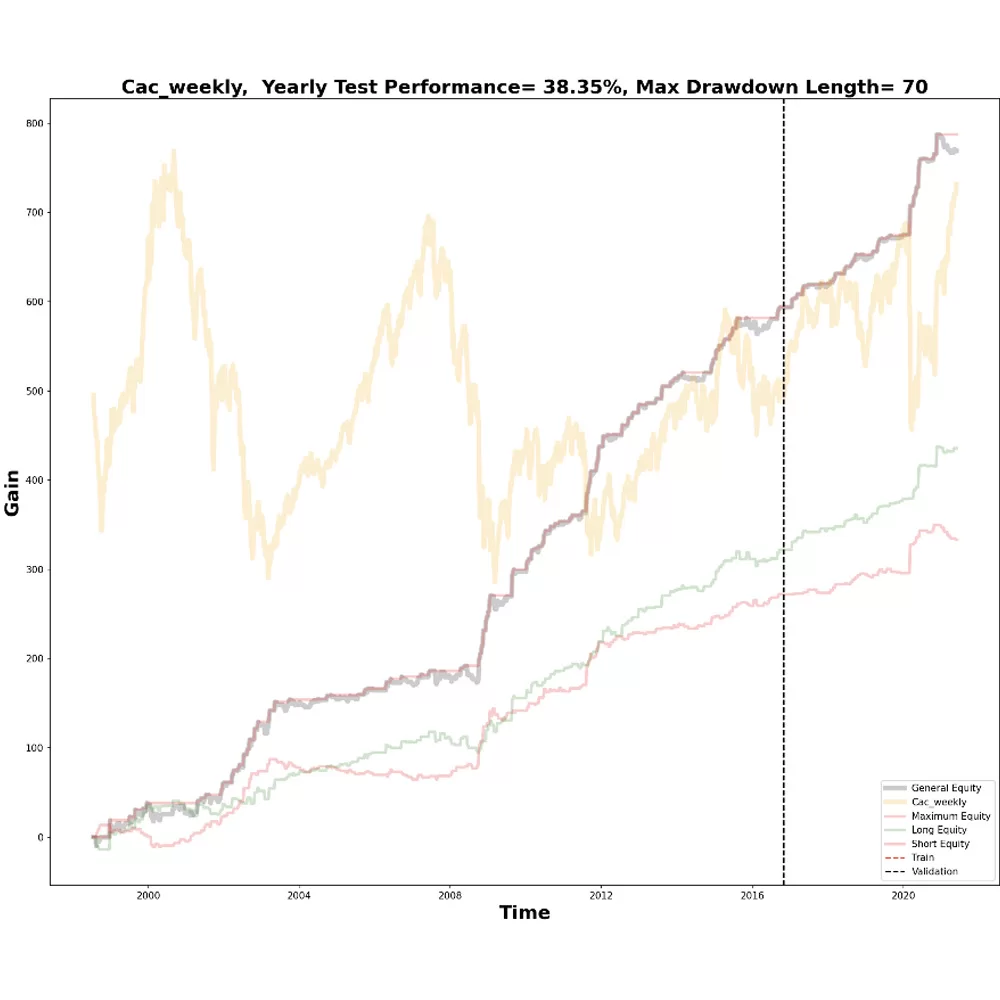

Our scientific approach is to examine the profile of each individual asset from multiple perspectives, searching for clues invisible to the human eye but which suggest future price movements.

Our team developed 1000+ independent and decorrelated algorithms that can be seen as autonomous “artificial traders” each having their own market approach to a given asset.

The ultimate goal is to create models from different branches of physics in order to describe and predict financial markets analyzing the psychology of the human traders.

Signal

Aggregation

An automated procedure looks for the less correlated best performing algos, preserving the approach diversification to each single asset. Algorithms are periodic filtered according to performance and drawdown, embedding information such as market trend and periodic yields. This selection of 500+ periodically renewed algorithms based on statistical tests of simulated time series under different market conditions forms a Virtual Board which decides whether to take a long, short or neutral position on a given asset in a totally quantitative procedure.

Reach out to us for inquiries, partnerships, or any questions you may have.

We’d love to hear from you!

Other Service

If you want to learn more about our other service, simply click on the sections to discover how our advanced algorithms can transform various industries.

ENERGY

Trading

Quaternion’s Data Science is used by authorized market operators on both the day-ahead market (MGP/MGAS) and on the Intraday markets (MI) to purchase and sell power & gas.